Minimize Fraud and Maximize Compliance

Fraud is truly a threat to any organization. It is estimated that typically an organization loses 5% of its annual revenue to fraud each year. According to a global report, based on 2,690 cases analyzed; almost 7.1 Billion US Dollars are lost to fraud every year.

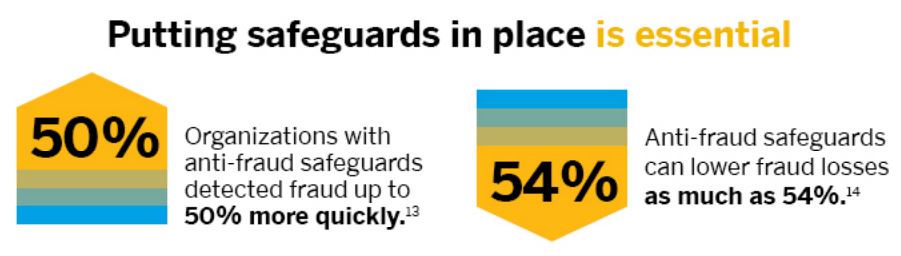

Corporate spending habits are changing and are becoming more and more complex with the increase in volume. Company owners and finance teams have very limited visibility and even less control over their business expenses. As a result, they are struggling to stay on top of it. When it comes to small and mid-size businesses, they have even fewer measures to control and catch this fraud. If organizations will not leverage the right technology to prevent and monitor fraud, they will keep on losing money. Just detection of fraud is not enough, you need to complement it with prevention and monitoring strategies.

Companies can take these proactive steps to monitor, identify, and prevent fraud:

- Adopt a solution that allows you to go for paperless submission of expense reports and give your employees the ease of use as well.

- Set audit rules like making the receipts mandatory for every itemized line item.

- Using a corporate card can ensure that travelers cannot modify their expenses. Also, you can set credit or transaction limits.

- The use of customized reports can help key stakeholders understand the collective travel and expense data and gain actionable insights.

- Continuous monitoring and analysis of the volume of expense reimbursements, personal payments, top spenders, cash advances, high mileage, etc.

Source – https://www.concur.com/en-us/resource-center/infographics/minimizing-fraud-maximizing-compliance

Interested ? Would you like to get in touch, write to us on inquiry@fintranssolutions.com