Concur Solutions

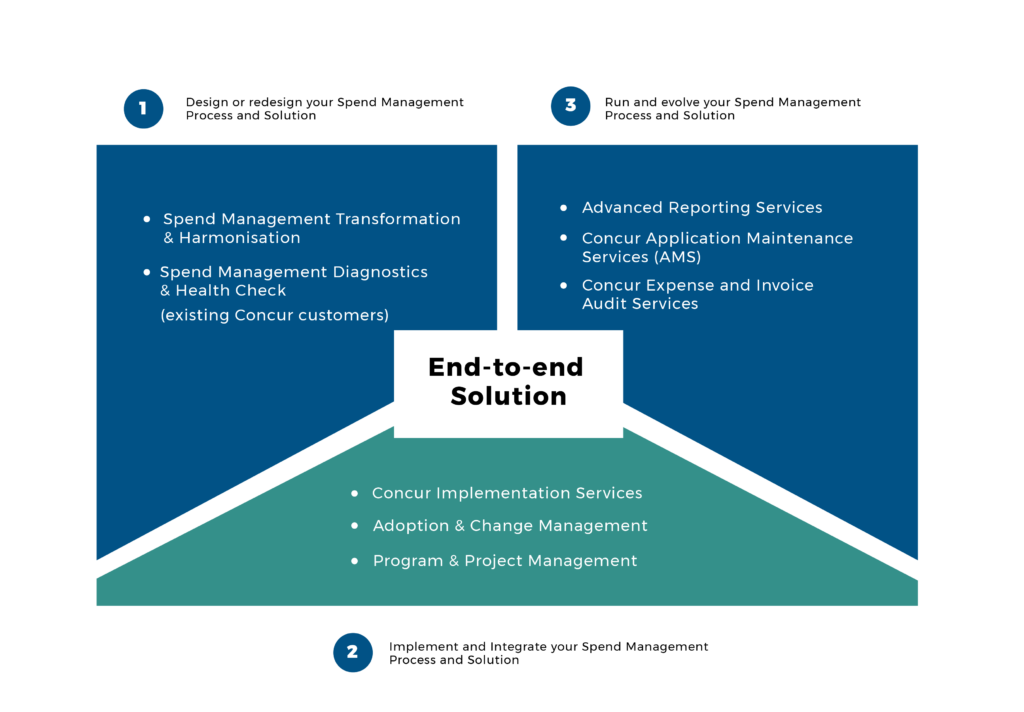

Welcome to FinTrans Solutions, your trusted partner in Intelligent Spend Management. As an SAP Concur certified Implementation Partner and premier consulting firm, we bring a wealth of expertise to empower organisations in transforming their spending processes. Our comprehensive suite of services is designed to enhance Travel and Expense (T&E) and Purchase-to-Pay (P2P) functions, ensuring efficiency, compliance, and cost-effectiveness.

Spend Management Transformation & Harmonisation

Embark on a journey of strategic Spend Management Transformation and Harmonisation with FinTrans Solutions. Our consultative approach is deeply ingrained in understanding your unique business needs, allowing us to tailor solutions that optimise your spending processes. We work collaboratively to align your financial objectives, harmonise disparate systems, and unlock new levels of efficiency.

Concur Implementation Services

Leverage the full potential of SAP Concur with our expert Concur Implementation Services. Our certified professionals guide you through the seamless integration of Concur solutions, ensuring a smooth transition and rapid deployment. From configuration to customisation, we are committed to delivering solutions that align with your organisational goals.

Adoption & Change Management

Navigate the complexities of change with our Adoption & Change Management services. We understand that successful technology adoption is not just about implementation; it’s about people. Our team collaborates with your workforce, providing training, communication strategies, leveraging adoption platforms, and support to ensure a smooth transition and widespread acceptance of new spending processes.

Program & Project Management

Rely on FinTrans Solutions for effective Program & Project Management. Our seasoned project managers orchestrate seamless implementations, ensuring timelines and budgets are met. With a focus on clear communication and meticulous planning, we guide your organisation through the complexities of spend management initiatives with confidence.

Advanced Reporting Services

Unlock actionable insights with our Advanced Reporting Services. Harness the power of data to make informed decisions and drive continuous improvement. Our reporting solutions provide real-time visibility into spending patterns, enabling you to optimise resources and enhance your financial control.

Concur Application Maintenance Services (AMS)

Ensure the longevity and efficiency of your Concur solutions with our Application Maintenance Services. Our dedicated team monitors, maintains, and updates your Concur applications, ensuring they stay aligned with evolving business needs and industry standards.

Spend Management Diagnostics & Health Check

Take a proactive stance with our Spend Management Diagnostics & Health Check Services. Our consultants conduct thorough diagnostics of your existing Concur instance to identify areas of improvement and perform health checks to ensure your spend management ecosystem operates at peak efficiency.

Concur Expense and Invoice Audit Services

Mitigate financial risks with our Concur Expense and Invoice Audit Services. Our expert auditors scrutinise expense reports and invoices to identify discrepancies, ensuring compliance and cost recovery.

At FinTrans Solutions, we are committed to elevating your Intelligent Spend Management journey. Partner with us to unleash the full potential of your spending processes, drive efficiency, and achieve sustainable financial success.

Request a Demo

FinTrans Solutions is regarded as one of the most trusted SAP Concur CIP partners globally. FinTrans Solutions pioneered this domain in the Asian market with its client-centric approach and – since then – rapidly gained recognition for delivery excellence globally. We have consistently been able to build on our expertise and create a reputation for sound analysis, seamless end-to-end implementation, and rock-solid application maintenance support across the globe.